Executive Summary

Executive Summary

The Thesis

AI is restructuring every layer of Indian commerce – from supply chain and logistics to customer acquisition, pricing, and product discovery (Section 00). India's e-commerce market – $125 billion today, projected to reach $345 billion by 2030 – is entering a once-in-a-decade platform shift in which AI-mediated commerce will account for $45–86 billion by 2030 (McKinsey, Bain). The opportunity spans the full stack, but the largest structural opening for new entrants is the purpose-built product intelligence layer – deep category experiences, cross-platform price intelligence, social signal aggregation, and AI-driven return reduction – that sits between consumer intent and merchant fulfilment (Section 01). General-purpose LLMs, marketplace AI, and horizontal wrappers each face structural limitations that prevent them from capturing this opportunity (Section 06).

Why India, Why Now

Four structural forces are converging simultaneously. First, India is the world's largest LLM market: ~65 million daily ChatGPT users, ~105 million Gemini MAUs, and the #1 Perplexity market globally – 64% of Indian consumers already use GenAI for shopping.[29] Second, India's shopping ecosystem is broken across four dimensions: choice overload (350 million+ Amazon India listings, 80 million+ Flipkart products), information overload (13-day average research journey[135]), broken trust (72% believe fake reviews are the norm[2]), and unsustainable returns (81% return rate – the world's highest[9]). Third, AI-referred traffic has crossed a conversion inflection – converting 31% better than non-AI traffic during Holiday 2025 (Adobe[31]), with revenue per visit up 254% YoY. Fourth, UPI – processing 228 billion transactions ($3.6 trillion) in 2025[40] – provides the zero-cost payment rail that makes agentic checkout possible at scale.

The Opportunity

Applying Bain's 15–25% AI-mediated share to India's projected $300–345 billion e-commerce market implies an India agentic commerce market of ₹3.7–7.2 lakh crore ($45–86 billion) by 2030.[95] Categories will fall sequentially: beauty and electronics first (already underway), grocery by 2027, and fashion by 2028+ (Section 07). The ecosystem impact is not zero-sum – consumers, D2C brands, marketplaces, logistics providers, and advertisers all face distinct opportunities and threats as AI reshapes commerce (Section 04). The revenue model that wins in India is bilateral: affiliate and brand intelligence on the consumer side, B2B SaaS selling performance analytics to the 11,000+ D2C brands facing unsustainable acquisition costs. Elite global VCs (Sequoia, Khosla, a16z, Forerunner, Lightspeed) have collectively deployed $428 million+ into AI commerce in 2025.[128]

Why Flash AI

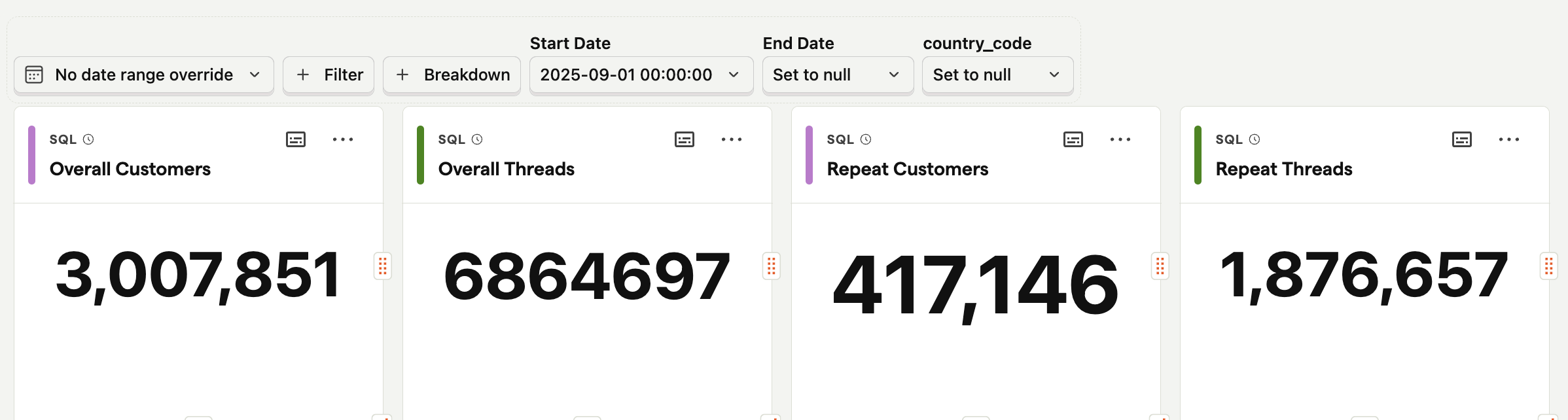

Flash AI is one of few startups that is simultaneously India-first, consumer-facing, and cross-category – positioning it at the intersection where the largest opportunity exists. Since launching in September 2025, Flash AI has reached 3 million users in six months with 50% month-over-month organic growth, placing it among the leading Commerce AI apps globally (SimilarWeb, February 2026).[110] The platform's zero-friction activation model (URL-append), compounding product intelligence graph with deep category experiences in beauty and electronics, and the founder's nine-year Flipkart tenure leading Fintech, Payments, and Checkouts provide strong founder-market fit for this category.

The Ask

Flash AI is raising a $10M Series A to scale MAU from 852K to 4 million active users by December 2026 and 12 million by December 2027, reach CM1 breakeven by scaling the hybrid affiliate + brand intelligence revenue model, and deepen the product intelligence graph across beauty, electronics, and the next category expansion into grocery. The timing window is 12–18 months. The company that captures India's product intelligence layer in 2026 will compound its data moat through 2030 and beyond.

Section 00

AI × Commerce: The Full Impact Map

AI is not reshaping just one part of commerce – it is restructuring the entire value chain. Before narrowing to the consumer-facing product intelligence layer that is the focus of this thesis, it is important to map the full landscape of where AI is creating value across Indian commerce. Each dimension represents a distinct opportunity with its own competitive dynamics, revenue models, and investment implications.

| Dimension | What AI Changes | Opportunity Scale | Key Players (India) | Maturity |

|---|---|---|---|---|

| Product Discovery & Research | ||||

| Conversational Product Intelligence | AI replaces search-and-filter with intent-driven, conversational product research and recommendations | $45–86B AI-mediated commerce by 2030[95] | Flash AI, Flipkart SLAP, Myntra MyFashionGPT | Early |

| Visual Commerce & Virtual Try-On | AR/AI-powered try-before-you-buy for fashion, beauty, furniture, eyewear | 2× conversion lift at Myntra; 25–40% return rate reduction potential[97] | Myntra (ModiFace), Lenskart, Nykaa, Flipkart Immerse | Early |

| Customer Acquisition & Marketing | ||||

| Generative Engine Optimisation (GEO) | Brands optimise for AI discovery instead of traditional SEO; structured data for AI agents | Gartner predicts 25% drop in traditional search by 2026;[67] ₹14,700 Cr e-commerce ad market shifting[82] | Peec AI, early Indian adopters reporting 40% brand citation growth in Gemini[69] | Nascent |

| Performance Marketing & AI-Driven Ads | AI automates ad creative, audience targeting, bid optimisation, and campaign management across channels | India digital ad spend ~₹49,000 Cr;[81] D2C CAC at ₹600–₹1,200 driving demand for AI alternatives[13] | Meta Advantage+, Google PMax, WebEngage, CleverTap, Haptik | Scaling |

| Martech & Personalisation Automation | Hyper-personalised product feeds, email/push content, dynamic merchandising, and lifecycle marketing | 35% of Amazon's revenue attributed to recommendation engine[136] | Myntra, Nykaa, Amazon India, Netcore, MoEngage, CleverTap | Maturing |

| Catalogue & Content Operations | ||||

| Content Generation & Cataloguing | AI-generated product descriptions, images, videos; automated catalogue enrichment at scale | 11,000+ D2C brands needing content at scale; ₹12–16B annual marketing spend[80] | Flipkart AI Catalogue Designer, Rocketium, Scalenut, Writesonic | Scaling |

| Supply Chain & Logistics | ||||

| Demand Forecasting & Inventory | ML models predict demand at SKU level, optimise inventory allocation, reduce stockouts and overstock | $33B reverse logistics market;[11] 25–30% order value consumed by inefficiency | Increff, Unicommerce, Locus, Flipkart supply chain AI | Scaling |

| Last-Mile Delivery & Route Optimisation | Route optimisation, dynamic dispatch, autonomous delivery planning, warehouse robotics | India logistics market ~$300B; last-mile accounts for 50%+ of delivery cost[137] | Delhivery, Locus, Ecom Express, Amazon India logistics | Scaling |

| Pricing & Payments | ||||

| Dynamic Pricing & Revenue Management | Real-time price optimisation based on demand signals, competitor pricing, inventory levels | 1–5% revenue uplift for retailers adopting AI pricing[138] | Flipkart pricing algorithms, Jio Commerce, global tools (Prisync, Competera) | Maturing |

| Agentic Checkout & Payments | AI agents execute purchases autonomously – find, compare, buy, pay – on behalf of consumers | UPI processed 228B transactions ($3.6T) in 2025;[40] zero-cost rail enables agentic payments | NPCI + OpenAI + Razorpay (pilot), BigBasket, Stripe ACP, Google/Shopify UCP | Nascent |

| Customer Service & Post-Purchase | ||||

| AI-Powered Support & Returns | AI agents handle returns, complaints, order tracking; voice bots in vernacular languages | Meesho's AI voice bot handles 60K calls/day with 75% cost reduction[57] | Meesho, Yellow.ai, Haptik (Jio), Freshworks | Scaling |

| Trust & Fraud Prevention | ||||

| Fraud Detection & Review Integrity | AI identifies fake reviews, fraudulent sellers, payment fraud, return abuse | 72% of consumers believe fake reviews are the norm;[2] BIS IS 19000:2022 regulatory push[53] | Amazon India ML systems, Razorpay, Cashfree, Signzy | Maturing |

Each of these dimensions carries distinct competitive dynamics and varying degrees of openness for new entrants. Section 01 examines why this thesis focuses specifically on product discovery and research – the dimension where the structural opportunity for startups is widest.

Section 01

Why Product Discovery & Research

Section 00 mapped the full landscape of AI's impact on commerce – from supply chain and logistics to customer acquisition, pricing, and fraud prevention. Each dimension represents a real opportunity. This thesis focuses on one: the consumer-facing product discovery and intelligence layer. Here is why.

1.1 The Problem: Product Discovery Is Broken

India's online shoppers face a compounding crisis across four dimensions. Choice overload: Amazon India lists 350 million+ items; Flipkart offers 80 million+ products – volumes that overwhelm any consumer's ability to navigate.[5][6] Information overload: the average purchase decision takes 13 days, with consumers consulting 10+ sources across marketplaces, YouTube, Reddit, expert blogs, and social media.[135][140] Broken trust: 72% of Indian consumers believe fake reviews are the norm; 59% say negative reviews are suppressed by platforms.[2][1] Unsustainable returns: 81% of Indian shoppers returned an online purchase in the past year – the highest rate globally – driven by poor purchase decisions that better information could have prevented.[9] Section 02 examines each of these dimensions in depth.

1.2 Why Incumbents Cannot Solve It

The platforms that control product discovery today are structurally incapable of fixing it. Marketplaces face a fundamental conflict of interest: Amazon India, Flipkart, and Myntra together generate ₹15,500+ crore (~$1.76B) annually from advertising – sponsored listings, banner ads, and promoted products that depend on consumers browsing their platforms.[65] An unbiased AI product intelligence layer that recommends the best product regardless of ad spend is fundamentally incompatible with their business model. They can build AI features within their walled gardens (Rufus, SLAP, MyFashionGPT), but they cannot build a platform-agnostic intelligence layer without cannibalising their highest-margin revenue stream. Section 06 examines this competitive gap across frontier models, marketplace AI, and horizontal wrappers in detail.

1.3 General-Purpose LLMs Demonstrably Fail

General-purpose models are not filling this gap either. ByteDance's ShoppingComp benchmark tested 120 tasks across 1,026 scenarios: GPT-5 achieved only 11.22% task completion; Gemini-2.5-Flash managed 3.92%.[16] The failures are structural, not incremental – hallucinated retailers, discontinued products listed as available, and an Apple Watch classified as a basketball shoe.[18][19][20]

1.4 Why Now: Multiple Structural Openings Converge

Several forces create a uniquely favourable moment for product discovery startups:

AI can now aggregate and synthesise like never before: For the first time, AI can ingest information from dozens of fragmented sources – marketplace listings, YouTube reviews, Reddit threads, expert blogs, social media, price trackers – and synthesise it into a single, trustworthy product intelligence layer. This capability did not exist at consumer scale two years ago. The 200× drop in LLM inference costs (Section 03) makes it economically viable to run these complex synthesis tasks at India's volume and price points.

Unsustainable acquisition costs: D2C brands pay ₹600–₹1,200 per customer on Meta and Google,[13] with CPCs rising 30–100% annually.[14] AI-powered discovery offers a structural alternative channel for brands – surfacing products based on quality and relevance rather than ad spend.

Commerce infrastructure is being built: The largest technology companies are building the open rails that make AI-mediated commerce possible at scale. Stripe and OpenAI's Agentic Commerce Protocol (ACP), Google and Shopify's Universal Commerce Protocol (UCP), PayPal's Agent Ready, and India's NPCI-OpenAI-Razorpay UPI pilot are creating standardised checkout, payment, and merchant-integration layers that product intelligence startups can plug into without building infrastructure from scratch.[43][44]

1.5 Elite VC Consensus

The signal from global venture capital is clear. Sequoia, Khosla Ventures, a16z, Forerunner, Lightspeed, and Index Ventures have collectively deployed $428 million+ into AI-first commerce startups in 2025 alone.[128] Sequoia's Konstantine Buhler explicitly believes an Amazon-scale ($2T+) company will form in this space. Forerunner raised a $500M Fund VII targeting AI consumer companies. Never in recent memory have this many top-tier VC firms simultaneously published dedicated investment theses on a single emerging category (Appendix B).

Thesis Scope

The remaining sections of this document focus on the consumer-facing product discovery and intelligence layer – the dimension where incumbent conflicts, LLM limitations, broken trust, and rising acquisition costs converge to create the clearest structural opening for a new category of startup. This is a deliberate analytical choice reflecting what we find most compelling for venture investment; the supply chain, logistics, GEO, and enterprise SaaS layers are each significant markets with their own investment logic.

Section 02

The Problem Landscape: Why This Space Exists

2.1 Choice Overload: Too Many SKUs, Not Enough Signal

The sheer volume of product listings on Indian e-commerce platforms has outpaced any consumer's ability to navigate them. Amazon India alone lists 350 million+ items across 25,000+ sub-categories;[5] Flipkart offers 80 million+ products across 80+ categories.[6] Fashion and accessories alone represent 60% of e-commerce transactions by volume.[7] A search for "moisturizer" on Amazon India returns over 10,000 results; "wireless earbuds" returns 4,000+. Shoppers face analysis paralysis: research shows that when consumers are presented with too many similar options, purchase probability drops by up to 10× compared to curated selections.[139] Traditional search-and-filter interfaces were designed for catalogues of thousands, not hundreds of millions – the tools have not kept pace with the inventory explosion.

2.2 Information Overload: Too Much Research, Too Many Sources

Even after narrowing choices, the research burden on Indian shoppers is staggering. The average purchase decision takes 13 days in considered categories,[135] with consumers consulting an average of 10+ sources before buying – marketplace listings, YouTube reviews, Reddit threads, expert blogs, price comparison sites, and social media recommendations.[140] Google data shows shoppers bounce between 3–5 platforms during a single purchase journey.[141] The information exists, but it is fragmented across dozens of sources, formats, and platforms – each with its own biases and limitations. This is the core structural gap: the internet has more product information than ever, but no single layer synthesizes it into trustworthy, personalised guidance.

2.3 Trust Has Collapsed in Indian E-Commerce

India's online shopping ecosystem suffers from a compounding trust crisis that traditional platforms have failed to resolve. A LocalCircles survey of 64,000 respondents found that 59% of consumers said low ratings or negative reviews were "not published" some or most of the time by e-commerce platforms.[1] An earlier survey of 18,000 respondents found 72% of consumers believe fake reviews have become the norm in Indian e-commerce, while 56% don't trust written reviews and 65% don't trust product ratings.[2] Some 62% experienced significant variation between product reviews and the actual product received. Only 9% feel platforms make it easy to identify sponsored or influencer reviews.[3]

Despite this distrust, 90% of Indian consumers still read reviews before purchasing[4] – creating a massive gap between reliance and reliability that an unbiased AI layer can fill. The tools designed to help – star ratings, bestseller badges, customer reviews – have been systematically compromised.

2.4 Returns Are an India-Specific Crisis

81% of Indian online shoppers returned something they bought in the past year, compared to just 48% in the US and 54% in Germany – making India the world's highest return-propensity market.[9] Fashion return rates in India run 25–40%, with the average online apparel return rate at 24.4% versus a global average of 16.5%.[10] The reverse logistics market in India stands at approximately $33 billion, with reverse-logistics expenses consuming 25–30% of order value on sub-₹1,200 items.[11]

Adobe's data offers a compelling proof point: AI-assisted buyers are 68% less likely to return products, because AI-guided purchases better match intent to product reality.[12]

2.5 CAC Is Spiraling Beyond Sustainability

Customer acquisition costs for Indian D2C brands have escalated dramatically, reaching ₹600–₹1,200 per customer.[13] Google Ads CPC rose 30–100% across categories in 2024, while Facebook CPMs climbed 25–40%.[14] With 800+ D2C brands competing for the same customer segments, the bidding war on Meta and Google has become structurally unsustainable. D2C funding reflected this pressure, declining to $757 million in 2024 from $930 million in 2023.[15]

An AI-powered discovery layer that drives high-intent, low-cost traffic represents a structural reset of these economics.

2.6 Why General-Purpose AI Fails at Shopping

ByteDance's ShoppingComp benchmark (November 2025) – 120 tasks, 1,026 scenarios, 35 domain experts – found GPT-5 achieved only 11.2% task completion; Gemini-2.5-Flash managed 3.9%.[16] Even OpenAI's specialized Shopping Research mode reaches only 52% accuracy on multi-constraint queries.[17] The failures are systematic, not edge-case: ChatGPT listed an Apple Watch among "basketball shoes evaluated,"[18] invented a retailer that didn't exist,[19] and Perplexity told users a product was "discontinued" while it was on the homepage.[20]

These reflect structural limitations, not tuning gaps. General-purpose LLMs rely on search indexes, lack real-time inventory and pricing data, carry no purchase history, and operate through a chat interface unsuited to visual, comparative shopping. The gap is architectural, not incremental. Section 06 examines this in depth.

Section 03

Why Now – The Inflection Point

3.1 India Is Now the World's Largest LLM Market

A BofA Securities analysis from December 2025 confirmed that India is the world's largest market for LLM adoption across ChatGPT, Gemini, and Perplexity combined.[21] The numbers are staggering:

ChatGPT: ~65 million daily active users, ~145 million monthly active users in India – over 16% of the global user base. India has the highest daily usage rate globally at 36% versus 17% worldwide.[22] ChatGPT Go launched at ₹399/month with UPI support (August 2025).[23]

Gemini: ~105 million MAUs in India, contributing 30% of Gemini's global monthly active users, with ~15 million DAUs.[24] Google is offering free Gemini AI Pro access through Jio for 18 months.[25]

Perplexity: India is the #1 market by MAUs, with 22.75% of all website visitors from India (versus 17.63% from the US). India MAUs grew 640% YoY in Q2 2025.[26] Airtel partnership gives all 360 million subscribers free Perplexity Pro for 12 months.[27]

These numbers are driven by structural factors: 806 million internet users, mobile data at $2 for 20–30GB monthly, and 60%+ of internet users under 35.[28] BCG reports 64% of Indian consumers now use GenAI tools for shopping – one of the highest rates globally.[29]

3.2 AI Traffic to Retail Is Exploding – And Converting

Adobe Digital Insights, tracking over 1 trillion visits to US retail sites, documented AI traffic growth of 1,100% in January 2025, accelerating to 3,100% by April and 4,700% by July 2025.[30]

A conversion-rate crossover occurred in September 2025: AI-referred traffic became 5% more likely to convert than non-AI traffic, widening to 16% by October and 31% during Holiday 2025.[31] AI-referred visitors showed 45% longer visits, 13% more pages per visit, and 33% lower bounce rates. Revenue per visit from AI sources was up 254% YoY.[32]

Bain & Company's analysis of ~30 million ChatGPT conversations (January–June 2025, via Sensor Tower) found shopping's share of prompts rose from 7.8% to 9.8% – effectively doubling shopping queries in six months. Click-throughs from ChatGPT tripled, with CTR jumping from 2.2% to 5.7%.[33] Approximately 50 million shopping queries flow through ChatGPT daily.[34]

3.3 AI Can Now Aggregate and Synthesise Like Never Before

For the first time, AI can ingest information from dozens of fragmented sources – marketplace listings, YouTube reviews, Reddit threads, expert blogs, social media, price trackers – and synthesise it into a single, coherent product intelligence layer. This is the capability that was missing from every previous attempt to fix product discovery. Earlier approaches (comparison engines, review aggregators, coupon tools) could only access structured data from a handful of sources. Modern LLMs combined with retrieval-augmented generation, real-time web crawling, and multimodal understanding can process unstructured video reviews, interpret nuanced community sentiment, cross-reference ingredient lists against dermatological research, and normalise technical specifications across brands – all in real time. The information consumers need to make good purchase decisions has always existed; it has just been scattered across dozens of platforms in incompatible formats. AI is the first technology capable of unifying it into a single, trustworthy layer that operates across platforms, categories, and languages.

3.4 LLM Cost Economics Have Crossed the Viability Threshold

The cost per query has dropped 200× in 18 months. GPT-4 launched at $30/$60 per million input/output tokens in March 2023. GPT-4o mini costs $0.15/$0.60 – a 99.5% reduction.[35] A typical shopping query (~1K tokens) costs less than $0.001 on GPT-4o mini. This makes consumer-scale AI shopping assistants economically viable in India, where willingness to pay is lower but volume is massive.

3.5 India's Gen Z: The AI-Native Consumption Cohort

India has 377–400 million Gen Z consumers (ages 13–28), the largest Gen Z cohort globally at ~27–30% of the population.[36] This cohort drives 43% of India's consumer spending (BCG/Snap).[37] 63% prefer online shopping to in-store (Mintel), and 23% trust AI platforms more than people for curated product recommendations (Commerce/Future Commerce survey).[38] 83% of Flash AI users are under 34.[39]

3.6 UPI: The Payment Rail AI Agents Need

UPI processed a record 21.63 billion transactions worth ₹27.97 lakh crore ($335B) in December 2025 alone, totaling 228.3 billion transactions ($3.6 trillion) for the full year – a 32.5% YoY volume increase.[40] UPI now processes ~698 million transactions daily, surpassing Visa globally.[41]

In October 2025, NPCI partnered with OpenAI and Razorpay to pilot agentic payments through ChatGPT using UPI, with BigBasket as the first merchant.[42] India's zero-MDR, instant-settlement, universally adopted payment rail is uniquely positioned to enable agentic checkout at scale – something the fragmented US payments landscape cannot replicate.

3.7 Protocol-Level Infrastructure Is Being Built

Two competing protocols are defining the AI-to-commerce transaction layer:

Agentic Commerce Protocol (ACP): Co-developed by Stripe and OpenAI (September 2025). Uses Shared Payment Token mechanism. Partners include Etsy (live), Shopify (1M+ merchants), Walmart, Target, and PayPal.[43]

Universal Commerce Protocol (UCP): Co-developed by Google and Shopify (January 2026). Models the entire shopping journey. 20+ endorsers include Flipkart, Best Buy, Visa, Mastercard, and American Express.[44]

India positioning: Flipkart is a listed UCP endorser, aligning with its Walmart parentage and Google's India push.[45] BigBasket has already piloted ChatGPT agentic payments (ACP-adjacent).[46] PayPal's Agent Ready (launching early 2026) serves as a universal connector across both protocols.[47]

3.8 The Incumbents Are Playing Defense

Amazon blocked 47 AI bots from accessing its platform on August 21, 2025, including crawlers from OpenAI, Anthropic, Meta, Google, and Mistral.[48] On November 4, 2025, Amazon filed a federal lawsuit against Perplexity AI to stop its browser agent "Comet."[49] Amazon generates ~$56 billion annually from ads dependent on people browsing Amazon.com.[50]

However, Amazon simultaneously expanded Buy For Me to 500,000+ items on third-party sites, signaling it would rather own the AI agent than block all agents. CEO Andy Jassy stated Amazon is "having conversations" with third-party agents.[51]

3.9 Regulatory Tailwinds

The US FTC's Rule on Fake Reviews (effective October 2024) imposes penalties of up to $51,744 per violation.[52] India moved first with BIS Standard IS 19000:2022, making it the first country with a framework for fake/deceptive online reviews.[53] CCPA has issued 325 notices for consumer protection violations.[54] The regulatory direction accelerates demand for AI-curated, platform-independent product intelligence.

"Consumer behavior changes that took 10+ years during the rise of e-commerce are now transforming in 12–24 months just as dramatically, if not more."

– Megan Hoppenjans, Executive Director of Strategy, VML (eMarketer, Jan 2026)

Section 04

How AI × Commerce Will Evolve

The AI commerce ecosystem is organizing into three structural layers – each with distinct competitive dynamics, investment implications, and stakeholder impacts. Understanding how these layers interact, and who benefits at each stage, is essential for identifying where defensible value accrues.

4.1 Three Distinct Layers Are Forming

| Layer | Description | Key Players | Investment Implication |

|---|---|---|---|

| General-Purpose AI | Massive user bases adding shopping features. ChatGPT processes ~50M shopping queries daily. | ChatGPT (800M+ WAU), Gemini (100M+ MAU in India), Perplexity (#1 market: India) | Breadth without depth; commoditizes basic product search |

| Product Intelligence Layer | Deep product understanding: review synthesis, cross-platform pricing, AI scores, return reduction | Flash AI, Phia ($185M val), Onton (2M+ MAU), Daydream ($50M seed) | Highest value accrual |

| Commerce Infrastructure | Payments, checkout, catalog sync for agent-ready commerce | Stripe (ACP), Google/Shopify (UCP), PayPal Agent Ready, Razorpay + NPCI | Enabler layer; India has UPI advantage |

4.2 How Indian Retailers Are Already Positioning

Flipkart: Launched SLAP (Shop Like a Pro), a standalone AI commerce app, in January 2026. Also built Immerse (multimodal search), AI Catalogue Designer for sellers, and endorsed Google's UCP.[55]

Myntra: MyFashionGPT makes users 3× more likely to complete a purchase. ModiFace virtual try-on drives 2× conversion in beauty across 11 brands and 3,000+ styles.[56]

Meesho: Deployed India's first GenAI voice bot for customer support, handling 60,000 calls daily with 95% resolution rate and 75% cost reduction.[57]

BigBasket: First Indian company to enable conversational commerce through ChatGPT with UPI payments (October 2025).[58]

Reliance/JioMart: Building foundational AI infrastructure through Google (Gemini 2.5 Pro for Jio users) and Meta (₹8.55 billion JV for Llama-based enterprise AI).[59]

4.3 McKinsey's Six-Level Automation Curve

McKinsey's automation curve (January 2026) provides the phasing framework:[60]

| Level | Description | Timeline | Category Fit |

|---|---|---|---|

| Level 0 | Programmed subscriptions | Today | Consumables, replenishment |

| Level 1 | Cognitive sidekick – assists research | 2025–2026 | Beauty, electronics, all research-heavy |

| Level 2 | Personal shopper – builds purchase-ready baskets | 2026–2027 | Multi-brand consideration purchases |

| Level 3 | Supervised executor – operates within consumer-set rules | 2027+ | Grocery, household essentials |

| Level 4 | Intent steward – optimizes against standing goals | 2028–2030 | Routine purchases, budget optimization |

| Level 5 | Agent-to-agent commerce | 2030+ | B2B, enterprise procurement |

4.4 Impact Across the Commerce Ecosystem

AI-mediated commerce does not affect all participants equally. The value chain shift creates new winners, new losers, and new dynamics across every stakeholder group.

Consumers: AI addresses the core problems outlined in Section 02 – collapsing 350 million+ listings into curated recommendations, compressing 13-day research journeys into minutes, and synthesizing independent sources instead of relying on platform-controlled reviews. Adobe data shows AI-assisted buyers are 68% less likely to return products[12] and AI-referred traffic converts 31% better than non-AI traffic.[31] The risk: if AI commerce layers are monetized primarily through advertising (as OpenAI has signaled[83]), the unbiased promise erodes.

D2C Brands: India's 11,000+ D2C brands[80] gain a structural alternative to the ₹600–₹1,200 per-customer acquisition cost on Meta and Google.[14] AI commerce surfaces brands based on product quality and relevance rather than ad spend. Phia's data shows brands see 13% higher conversion, 30% stronger new customer acquisition, and 50%+ return reduction.[116] The challenge: brands must adapt for AI discoverability – structured data, GEO optimisation, agent-ready catalogues.

Marketplaces: The impact is dual. AI agents that bypass sponsored listings directly threaten marketplace advertising – a ₹15,500+ crore revenue stream.[65] But marketplace AI features also drive engagement: Rufus users are 60% more likely to complete a purchase (est. $12B incremental sales[117]); MyFashionGPT users are 3× more likely to convert.[122] The question: does an independent AI intelligence layer capture the consumer relationship before marketplace AI features become the default?

Logistics & Fulfilment: India's $33 billion reverse logistics market[11] shrinks if AI-assisted buyers return 68% fewer products. Better demand prediction enables more efficient last-mile delivery across India's ~$300B logistics market.[137]

Advertisers: AI commerce shifts marketing from impression-based (display ads, sponsored listings) to intelligence-based (GEO, performance marketing through AI surfaces). India's digital ad spend reached ~₹49,000 crore in FY2025;[81] the migration from search-based to intelligence-based marketing spend is accelerating as Gartner predicts a 25% decline in traditional search volumes by 2026.[67]

4.5 The Infrastructure Rails Are Being Built

The largest technology companies are not building the product intelligence layer – they are building the infrastructure rails that startups will ride on.

OpenAI + Stripe (ACP): The Agentic Commerce Protocol (September 2025) created a standardized checkout layer that any AI application can plug into. Walmart, Target, Etsy, and 1M+ Shopify merchants are already ACP-enabled.[43][61]

Google + Shopify (UCP): The Universal Commerce Protocol (January 2026) models the entire shopping journey as an open standard. 20+ endorsers including Flipkart, Best Buy, Visa, Mastercard, and American Express.[44][45]

Shopify (Agentic Storefronts): Any brand can sell on AI channels from a central admin, making millions of merchants agent-ready out of the box.[70]

PayPal (Agent Ready): Launching early 2026, instantly unlocks millions of existing merchants for AI-surface payments – a universal connector across both ACP and UCP protocols.[47][85]

Amazon (Buy For Me): Expansion to 500,000+ items on third-party sites signals that even the largest incumbent is embracing agent-mediated purchases beyond its own marketplace.[51][62]

The Startup Opportunity

Product intelligence startups currently operate at Level 1–2 on McKinsey's automation curve. The infrastructure rails (ACP, UCP, PayPal Agent Ready, Shopify Agentic Storefronts) directly accelerate their progression – enabling one-click checkout across millions of merchants without building payment infrastructure from scratch. The giants build the platform; the category-defining company builds the intelligence on top. AI commerce is not zero-sum: consumers, D2C brands, and logistics providers are net beneficiaries. The largest new value pool – the consumer-facing product intelligence layer – is where the structural opening for new entrants is widest.

Section 05

Where Value Will Be Created

5.1 The Shopping Journey Compresses From Five Steps to Three

Traditional e-commerce follows a five-step journey: search → browse → compare → read reviews → buy. AI-mediated commerce compresses this to three: state intent → delegate to AI → confirm purchase. This compression eliminates the layers where most current value extraction occurs – and creates new layers where entirely new value can be built.

5.2 Where Value Is Destroyed

Marketplace advertising (₹15,500+ crore at risk): AI agents that bypass sponsored product listings fundamentally undermine marketplace advertising – the highest-margin revenue stream for Indian e-commerce platforms (see Section 06 for the full ad revenue breakdown).[65]

SEO and last-click attribution: Google's AI Overviews have already reduced CTR for top-ranking content by 30%+ in one year.[66] When consumers get curated product answers from AI agents with embedded checkout, traditional SEO-driven product pages lose relevance. Last-click attribution collapses as the AI intermediary absorbs the attribution. Gartner predicts a 25% drop in traditional search volumes by 2026.[67]

Marketplace funnel monopoly: For two decades, marketplaces have owned the entire funnel – discovery, comparison, trust signals, and checkout all happened within Amazon or Flipkart. AI agents break this bundling apart. The marketplace becomes one of many fulfilment options, not the default destination.

5.3 Where New Value Is Created

The product intelligence layer: A new layer of value emerges between consumer intent and merchant fulfilment – the AI-powered product intelligence layer that aggregates cross-platform data, synthesizes independent reviews, and delivers unbiased recommendations. This layer did not exist before and captures value from the trust deficit that platforms created.

GEO (Generative Engine Optimization): As traditional SEO loses effectiveness, GEO becomes the new discoverability strategy. Companies like Peec AI ($29 million funded, 1,300+ brands) are building the tooling.[68] Early Indian adopters report 40% brand citation growth in Gemini within three months.[69] This is an entirely new value pool that did not exist two years ago.

Agent-ready commerce infrastructure: Brands must now expose structured data, inventory, and pricing to AI agents – creating demand for new tooling and integration layers. Shopify's Agentic Storefronts allow any brand to sell on AI channels from a central admin.[70]

Agnostic checkout: When an AI agent can compare prices across Nykaa, Amazon, and Flipkart, then complete the purchase through embedded UPI – the checkout layer itself becomes platform-agnostic. Stripe's ACP, PayPal's Agent Ready, and Google/Shopify's UCP are all building the rails for this new value layer.[43][44]

Section 06

Why Frontier Models & Incumbents Won't Capture This

With $45–86 billion at stake in India alone, a natural question is: why won't ChatGPT, Gemini, Amazon Rufus, or Flipkart SLAP simply capture this market? The answer is structural – three distinct categories of competitors face three distinct categories of limitations. The gap between any of them and a purpose-built commerce AI is not incremental; it is foundational.

Competitor Type 1: Frontier Models (ChatGPT, Gemini, Claude, Perplexity)

6.1 The Performance Gap: Benchmark Evidence

ByteDance's ShoppingComp benchmark (November 2025) tested 120 tasks across 1,026 scenarios curated by 35 domain experts. The results are sobering: GPT-5 achieved only an 11.22% task completion rate; Gemini-2.5-Flash managed just 3.92%.[16] Even OpenAI's specialized Shopping Research mode reaches only 52% product accuracy on multi-constraint queries.[17]

The failure modes are not edge cases – they are systematic. Yotpo's 2025 testing found ChatGPT listed an Apple Watch among "basketball shoes evaluated" – a pure hallucination.[18] The Verge discovered ChatGPT invented a retailer called "Store Collectibles" that didn't exist.[19] A Wildmagic audit found Perplexity told users a product was "discontinued" when it was actively on the homepage.[20]

6.2 The Incentive Conflict: Ads vs. Unbiased Recommendations

OpenAI has announced plans to test ads in ChatGPT, projecting $1 billion in "free user monetization" by 2026 and ~$25 billion by 2029.[83] Google's Gemini is structurally tied to Google's $307 billion advertising business. When the revenue model depends on advertising, product recommendations become commercially influenced – the exact problem that broke marketplace reviews in the first place. A purpose-built commerce AI whose revenue comes from affiliate commissions and brand performance fees has structurally different incentives: it makes money when consumers make good purchase decisions, not when they click ads.

6.3 The Data Gap: What General-Purpose Models Cannot See

General-purpose LLMs rely on web search indexes for product information – fundamentally limiting them to what Google or Bing have indexed. They lack: real-time inventory and pricing data across marketplaces, cross-platform price comparison at the SKU level, social signal aggregation (YouTube reviews, Reddit threads, expert blog analysis), post-purchase data (return rates, satisfaction signals, sizing accuracy), and consumer intent patterns across categories. A purpose-built commerce AI accumulates these data layers as a compounding moat – every product research interaction adds signal that improves the next recommendation. This is the data flywheel that frontier models, by design, cannot build.

6.4 The Interface Gap: Chat Is Not Shopping

Shopping is fundamentally a visual, comparative activity. Consumers want to see products, compare prices side by side, scan structured pros and cons, browse alternatives, and make decisions based on images and layout – not read paragraphs of text in a conversational thread. Frontier models are built around a chat interface optimized for dialogue, not for the browsing, comparing, and deciding that characterizes real purchase behavior. A purpose-built commerce AI delivers a shopping-native interface: visual product cards, structured comparisons, filters, price tracking, and one-click purchase flows.

6.5 Deep Category Experiences: The Moat Frontier Models Cannot Replicate

The most powerful differentiator between a general-purpose LLM and a purpose-built commerce AI is the depth of category-specific intelligence. In beauty and personal care, this means AI-powered skin analysis that matches products to skin type, tone, and concerns; ingredient compatibility engines that flag allergens and contraindicated combinations; face shape analysers for makeup and eyewear; and virtual try-on for shade matching. In electronics, it means structured spec-comparison tools that normalize specifications across brands, expert-review synthesis weighted by credibility, and compatibility checkers for accessories and peripherals. In fashion, it means body-type fit engines trained on return-reason data, size recommendation models that reduce wrong-size returns by 25–40%,[108] and style-profile matching that learns from purchase and browse history.

These category experiences require domain-specific data pipelines, proprietary training data from millions of consumer interactions, and deep integration with product catalogues that frontier models do not have and cannot easily build. A general-purpose LLM can answer "what moisturizer is good for dry skin" with web-search-quality results. A purpose-built commerce AI can analyse the user's skin type from a photo, cross-reference ingredient compatibility with their existing routine, compare formulations across 15 brands, surface real user reviews from people with similar skin profiles, and track price history to recommend the best time to buy – all in a visual, shopping-native interface. The depth of this experience compounds with every interaction: the more users research in a category, the more precise the recommendations become.

This is not a feature gap that frontier models will close by adding a shopping tab. It requires purpose-built data infrastructure, category-specific model tuning, merchant integrations, and years of accumulated consumer interaction data.

6.6 What It Takes: The Purpose-Built Commerce AI Stack

The table below maps the structural gap across every dimension that matters for shopping. These are not incremental differences – they represent fundamentally different architectures, data models, and user experience philosophies.

| Dimension | General-Purpose LLMs (ChatGPT, Claude, Gemini) | Purpose-Built Commerce AI |

|---|---|---|

| Deep Product Research | Web search, surface-level summaries from top indexed results | Multi-source aggregation (50+ sources per product) – YouTube, Reddit, expert blogs, marketplaces |

| Price Intelligence | Web search, often outdated or incomplete; no real-time inventory access | Real-time multi-marketplace price tracking, historical price data, deal alerts |

| Alternatives & Comparisons | Ad hoc text responses; no structured comparison framework | Structured visual comparisons with pros/cons, spec normalization, and unbiased ranking |

| Deep Category Experiences | Generic responses regardless of category; no domain-specific tooling | Skin analysers, ingredient engines, spec comparators, fit engines, virtual try-on – each built for the category |

| Activation Friction | Chat-based; user must describe product from scratch; requires prompting skill | URL append, share-to-app, browser extension; zero prompting required |

| Interface | Chat-only – text-heavy, not built for browsing or visual comparison | Shopping-native: visual product cards, search, browse, compare, one-click purchase |

| Economics | High – fresh LLM call per query; no caching or pre-computation | Cached intelligence, pre-computed product graphs; declining cost per interaction |

| End-to-End Support | Stops at recommendation; no post-purchase layer | Full loop: research → purchase → order tracking → logistics → return support |

| Social Intelligence | Relies on search-indexed text; ignores video reviews, community sentiment | Aggregates YouTube reviews, Reddit threads, expert blogs, and community signals |

| Trust & Bias | Increasingly ad-monetized; recommendations commercially influenced | Platform-agnostic; revenue aligned with consumer outcomes, not ad spend |

| Consumer Data Moat | No persistent shopping profile; no cross-session preference learning | Compounding product intelligence graph from millions of research interactions |

"ChatGPT and LLM-based tools like Perplexity piggyback off existing search indexes like Bing or Google. That makes them really only as good as the first few results that come back."

– Zach Hudson, CEO of Onton (TechCrunch)[8]

Competitor Type 2: Marketplaces & Their AI Features (Amazon, Flipkart, Myntra)

The competition here is not only with marketplace AI agents like Rufus, SLAP, or MyFashionGPT – it is with the marketplaces themselves. Amazon, Flipkart, and Myntra are where the vast majority of Indian e-commerce transactions already happen. They have the traffic, the catalogues, the payment infrastructure, and the brand relationships. The question is whether they can also become the unbiased product intelligence layer that consumers need – and the answer is structurally no, for three reasons.

6.7 The Ad Revenue Conflict

Marketplaces' highest-margin revenue depends on the very behavior AI-powered product intelligence eliminates: browsing sponsored listings.

| Platform | Ad Revenue (FY2025) | % of Total Revenue | Source |

|---|---|---|---|

| Amazon India | ₹8,342 crore ($945M) | 28% | IBEF |

| Flipkart | ₹6,317 crore ($716M) | 31% | Best Media Info |

| Myntra | ₹914 crore (~$103M) | Significant share | TMO Group |

| Total | ₹15,500+ crore (~$1.76B) | Growing 25–28% annually | Multiple[65] |

Amazon Rufus demonstrates the constraint in action: while Rufus users are 60% more likely to complete a purchase (generating est. $12B incremental sales[117]), Rufus can only recommend Amazon products. It cannot tell a shopper that the same product is ₹200 cheaper on Flipkart, that Nykaa has a better formulation, or that an independent D2C brand on Shopify offers superior quality. Similarly, Flipkart's SLAP and Myntra's MyFashionGPT are architecturally limited to their own catalogues. Every recommendation these tools make is constrained to the inventory their parent platform sells – and influenced by the advertising revenue that inventory generates. These are AI-enhanced storefronts, not AI-powered product intelligence.

6.8 Walled Gardens Cannot Be Unbiased or Universal

The fundamental limitation of marketplace-based product intelligence is that it can never be unbiased or universal. A marketplace has a financial interest in every transaction staying on its platform. It will never surface a competitor's lower price, a D2C brand's superior formulation, or an independent retailer's better warranty. Marketplace AI features are structurally single-platform tools: they cannot aggregate reviews from YouTube, Reddit, and independent expert blogs; they cannot compare prices across competitors; they cannot synthesise social signals from platforms they don't own.

An Indian shopper comparing smartphones needs intelligence from Amazon, Flipkart, Croma, Samsung's D2C store, YouTube reviewers, Reddit communities, and price tracking tools – simultaneously. No marketplace will provide this because doing so would expose its own pricing disadvantages and send traffic to competitors. This is the structural opening for an independent, platform-agnostic product intelligence layer: one that has no inventory to sell, no ad revenue to protect, and no reason to favour one platform over another. Its only incentive is to help the consumer make the best possible purchase decision – wherever that product happens to be available. That alignment between consumer interest and business model is something no marketplace can replicate without cannibalising its own economics.

Competitor Type 3: Horizontal AI Wrappers

6.9 The Honey Lesson: Why Thin Wrappers Fail

Honey was acquired by PayPal for $4 billion on 17 million users – then lost 3 million+ users in two weeks after an investigation exposed affiliate cookie manipulation.[78] Honey's failure exposed the fragility of "thin wrapper" AI commerce: browser extensions and coupon overlays that add a shallow convenience layer without building proprietary product intelligence. When the value proposition is "we find you a coupon code," the switching cost is zero and the trust floor has no foundation.

Today's horizontal wrappers – browser-extension tools that overlay basic AI on top of marketplace pages – face the same structural weakness. Without deep category intelligence (skin analysers, ingredient engines, spec comparators), without proprietary product data from millions of research interactions, and without cross-platform price intelligence, they are thin interfaces sitting on top of commodity LLM APIs. When the next frontier model improves, the wrapper's differentiation evaporates. Purpose-built commerce AI builds the opposite: compounding category intelligence that deepens with every interaction, creating switching costs and data moats that no thin wrapper can replicate.

The Structural Conclusion

Three categories of competitors – frontier models, marketplace AI, and horizontal wrappers – each face distinct but equally structural limitations. Frontier models lack the data, interfaces, and incentive alignment. Marketplace AI is imprisoned by its own ad revenue model. Horizontal wrappers lack the depth to build defensible moats. The $45–86 billion AI commerce opportunity in India requires a fundamentally different stack: real-time product data, deep category intelligence, shopping-native interfaces, consumer-aligned incentives, and compounding consumer interaction data. This is the domain of purpose-built commerce AI – and it is why the most successful AI commerce startups globally (Phia, Onton, Daydream) are all purpose-built, not wrappers or marketplace bolt-ons.

Section 07

TAM / Market Sizing – Categories That Fall First

7.1 India's E-Commerce Market Trajectory

India's e-commerce market reached $125 billion in 2024 (IBEF/ANAROCK), with e-retail GMV at ~$60 billion (Bain/Flipkart).[88] Projections for 2030 range from $300 billion (Redseer) to $345 billion (IBEF), representing a 15% CAGR.[89] India surpassed the US as the world's second-largest e-retail shopper base after China, with 260–280 million online shoppers today, projected to reach 500 million by 2030.[90]

7.2 Sizing the AI Commerce Opportunity

Bain projects US agentic commerce at $300–500 billion by 2030, representing 15–25% of e-commerce.[92] Gartner forecasts 33% of enterprise software will incorporate agentic AI by 2028, with $15 trillion in B2B spend agent-intermediated.[93] Applying Bain's 15–25% share to India's projected $300–345B e-commerce market implies an India agentic commerce market of ₹3.7–7.2 lakh crore ($45–86 billion) by 2030. Even at a conservative 10% penetration, the opportunity exceeds $30 billion.

7.3 Category Sequencing: What Falls First

Phase 1: Beauty & Personal Care (Now) – $28–33B Market

India's BPC market stands at $28 billion (2024), growing to $33 billion by 2025. Online BPC grew 39% YoY (NielsenIQ).[96] This category disrupts first because purchase decisions are research-heavy (ingredients, skin type matching), return rates are lowest (<5%), and virtual try-on has proven 2× conversion lift at Myntra.[97] Repeat rates are highest at 30%, making AI-driven reorder automation high-value.[98] Flash AI confirms: beauty and electronics together account for two-thirds of all products users research.[99]

Phase 2: Electronics (Now) – 48–70% of E-Commerce by Value

Electronics held 48–70% of e-commerce by value, with consumer electronics at 20–22% of e-retail GMV.[100] Products have objective, comparable specifications that AI excels at synthesizing. Adobe data confirms AI traffic converts highest in electronics – research-intensive categories where AI referral traffic share is 4× that of apparel/footwear.[101] 87% of AI users are more likely to leverage AI for large, complex purchases.[102]

Phase 3: Grocery (2027) – $7.4B Quick-Commerce GOV

BigBasket became the first Indian retailer to enable grocery + UPI payments through ChatGPT (OpenAI DevDay 2025, with NPCI and Razorpay).[103] Quick-commerce: $7.4 billion GOV in FY2025, growing 40%+ annually through 2030 (Bain).[104] Repeat purchases, standardized SKUs, and low subjectivity make grocery ideal for full agentic commerce.

Phase 4: Fashion (2028+) – 60% of Transactions by Volume

The largest category by transaction volume with 31.67% of GMV.[105] Fashion return rates in India run 25–40%, with 70% related to sizing issues.[106] McKinsey categorizes fashion as "identity-oriented," where consumer delegation stalls at Levels 1–2.[107] Progress is real: Zalando's AI virtual try-on has 30,000+ users with 5–10% return reduction projected, and AI size recommendations can reduce wrong-size returns by 25–40%.[108]

| Category | India Market Size | AI Readiness | Key Enabler | Timeline |

|---|---|---|---|---|

| Beauty & Personal Care | $28–33B (10% CAGR) | Highest | Objective attributes, ingredient data, <5% returns | Now |

| Electronics | 48–70% of e-com value | High | Spec-driven comparisons, high ticket size | Now |

| Grocery | $7.4B q-commerce GOV (40%+ growth) | Medium-High | Standardized SKUs, UPI agentic payments | 2027 |

| Fashion | 60% of txns, 31.67% GMV | Medium-Low | Virtual try-on, size AI (25–40% return rates) | 2028+ |

The Startup Opportunity

The category sequencing framework points to a clear entry strategy for AI commerce startups: begin where AI adds the most immediate value (beauty and electronics), demonstrate measurable conversion and return-rate improvements, then expand into adjacent categories as trust and data compound. The startups that execute this sequencing – building category depth before horizontal breadth – will accumulate the proprietary product intelligence data that becomes the defining moat.

Section 08

Revenue Models – With Global Parallels

Stream 1: Affiliate and Referral Revenue – Proven But Must Be Done Right

India's affiliate marketing market stood at $510 million in 2024, projected to reach $639 million by 2026.[74] Amazon India offers 1–5% commissions (up to 5% on fashion); Flipkart offers 0.5–5%; Myntra pays 3.75–7.5%.[75] With India's e-retail GMV at ~$60 billion and average 4–6% commission rates, the addressable affiliate pool is $2.4–3.6 billion today, scaling to $10–15 billion by 2030.[76]

Global parallel – Honey: Acquired by PayPal for $4 billion on 17 million users and ~$300M in affiliate revenue – demonstrating that an AI-powered layer between consumer intent and merchant offers can build a multi-billion-dollar outcome on affiliate economics alone.[77]

Stream 2: B2B SaaS – Selling Intelligence to Brands

Phia's model: brands see 13% higher conversion, 30% stronger new customer acquisition, 15% increased AOV, and 50%+ return reduction. Phia charges zero upfront, monetizing through performance-based models.[79] India has 11,000+ D2C companies (~800 funded), with total D2C marketing spend of $12–16 billion annually.[80] The B2B approach has the cleanest unit economics for India because willingness to pay sits with brands, not consumers.

Global parallel – TripAdvisor: Built a $1.6B+ annual revenue business as the intelligence layer between consumer intent and hotel/restaurant booking – the exact same structural position AI commerce platforms occupy for products.

Stream 3: Advertising Revenue Migration

India's total ad spend crossed ₹1,00,000 crore in FY2025, with digital capturing 44–46% (~₹49,000 crore).[81] E-commerce's share of digital ad spend is ~30%, and e-commerce advertising grew 50% in 2024 to ₹14,700 crore (~$1.75B).[82] OpenAI announced plans to test ads in ChatGPT, projecting $1 billion in "free user monetization" by 2026 and ~$25 billion by 2029.[83]

Stream 4: Transaction and Checkout Fees

Stripe's ACP and PayPal's Agent Ready build the rails for AI-to-commerce transactions. PayPal's approach – instantly unlocking millions of existing merchants for AI-surface payments with no technical lift – is particularly relevant for India's fragmented merchant ecosystem.[85] The transaction model takes a small percentage per completed purchase and scales with GMV.

Global parallel – Instacart: First grocery partner to launch embedded shopping inside ChatGPT. Transaction fees on AI-mediated orders. BigBasket's ChatGPT+UPI integration is the Indian equivalent.

Stream 5: Subscription and Premium – Limited TAM in India

Perplexity Pro ($20/month, free via Airtel) and ChatGPT Go (₹399/month) demonstrate willingness to pay.[86] But Indian consumers consider ₹200–300/month an affordable AI subscription – ChatGPT had 29 million downloads in India in three months but generated only $3.6 million in revenue.[87] This model works for the top 25 million "power shoppers" but struggles to reach the next 250 million.

India-Optimal Revenue Model

A hybrid of affiliate (consumer-facing) + B2B SaaS (brand-facing) + Advertising is the most defensible combination. Affiliate generates revenue from day one on existing merchant relationships (Amazon India, Flipkart, Myntra), while B2B SaaS builds the stickier, higher-margin revenue stream selling product intelligence and agent-readiness tools to D2C brands facing ₹600–₹1,200 CAC.

Section 09

Risks and Why They're Manageable

| Risk | Assessment | Mitigation |

|---|---|---|

| Platform access (Amazon blocks AI crawlers) | Amazon blocked 47 bots and sued Perplexity. Could limit data access for AI shopping platforms. | ACP/UCP protocols create merchant-driven incentives for openness. Amazon's own Rufus generated $12B in incremental sales. Startups can focus on brand sites (Shopify/D2C) initially. |

| ChatGPT / Perplexity add better shopping | 11% accuracy on complex tasks, hallucination risks, no real-time inventory. Structural limitations, not resource constraints. | Vertical AI with deep data pipelines maintains 3–13× conversion advantage. The gap is architectural. |

| Incumbent response | Flipkart, Amazon, Myntra and others are adding AI features. Marketplace AI is inherently conflicted – prioritizes marketplace revenue. | Independent platforms are inherently more unbiased than marketplaces – they can aggregate discovery and intelligence across all marketplaces and sources (competitor pricing, independent reviews, social sentiment), and deliver purpose-built shopping experiences that marketplace bolt-ons cannot match. Trust, neutrality, and depth of experience compound over time into a structural advantage. |

| Honey-style trust blowback | Honey lost 3M+ users in two weeks after affiliate manipulation exposed. Affiliate models are fragile without genuine value. | Transparency in monetization, alignment with brands (not against creators), and clearly disclosed models are table stakes. The lesson makes this generation stronger. |

| Data scraping legal risk | NYT, Reddit, others sued Perplexity for unauthorized scraping. Courts haven't ruled on RAG-based summarization. | AI shopping tools source data through legitimate affiliate APIs, merchant data feeds (Shopify, UCP/ACP), and consented interactions. Flash AI overlays on user-initiated visits; Phia has 6,200+ brand partnerships. |

| Unit economics at India price points | Low AOVs challenge commission models. Average 4–6% commission on lower basket sizes. | LLM costs dropped 200× in 18 months (GPT-4o mini: <$0.001/query). Cached intelligence lowers marginal cost. Flash AI's ₹5 CAC and B2B brand-funded model de-risk unit economics. |

Section 10

What to Look for in a Winning Company

10.1 Low Customer Acquisition Cost

The winning AI commerce startup acquires users at a fraction of D2C industry averages (₹600–₹1,200[13]) through organic, product-led growth. Low-friction activation mechanics – browser extensions (Phia), URL-append models (Flash AI), share-to-app flows, or embedded widgets – enable viral distribution without paid marketing dependency. In India, where 806 million internet users span wildly different levels of tech fluency and device capability, the lowest-friction path to first value wins. The ideal activation delivers value on the first interaction with no account creation, no preferences to set, and no learning curve.

10.2 Brand Buy-In and Revenue Model Alignment

Consumer subscription models struggle at Indian price points – ChatGPT had 29 million downloads in India in three months but generated only $3.6 million in revenue.[87] The winning model aligns revenue with brand outcomes: affiliate commissions, performance-based B2B SaaS, and brand intelligence products. Phia's 6,200 brand partners in 10 months[116] demonstrates that brands will pay for AI-driven customer acquisition when the model is zero-risk and performance-based. India has 11,000+ D2C companies with $12–16 billion in annual marketing spend[80] – making the brand-funded model both scalable and sustainable.

10.3 Data Moat and Product Intelligence

The defining moat in AI commerce is proprietary product intelligence data that improves with every interaction: cross-platform pricing signals, user preference patterns, return-reason data, conversion-by-recommendation analytics, and category-specific knowledge graphs. Consumer-side intent data – what people research, compare, and ultimately buy – is the hardest data to replicate and the most valuable for brands. The startup that accumulates millions of consumer research interactions builds a compounding advantage that new entrants cannot easily match, regardless of the underlying LLM capability.

10.4 Deep Category Experiences That Beat Frontier Models

As Section 06 establishes, general-purpose LLMs cannot compete on category-specific intelligence. The winning company builds purpose-built category experiences – skin analysers and ingredient engines in beauty, structured spec comparators in electronics, fit engines in fashion – that deliver a level of product understanding and personalisation that no chat-based interface can replicate. These experiences require domain-specific data pipelines, proprietary training data, and deep merchant integrations. Each category experience deepens the moat: the more users research within a category, the more precise the recommendations become. The ability to build and scale these deep category layers is what separates a defensible commerce AI from a thin wrapper around an LLM API.

10.5 Category Scalability

Vertical depth should precede horizontal breadth – the most successful AI shopping startups begin deep in one or two categories (Phia in fashion, Onton in furniture[119]) and expand once category intelligence is demonstrably superior. But the winning company must also have a credible path to cross-category expansion. The category sequencing framework (Section 07) provides the playbook: beauty and electronics first, grocery by 2027, fashion by 2028+. A startup locked into a single vertical caps its TAM; one that can replicate its category intelligence model across adjacent categories unlocks the full $45–86 billion opportunity.

10.6 India-First, Globally Scalable

Building for India's uniquely challenging commerce environment – vernacular requirements, extreme price sensitivity, 81% return rates, a compounding trust crisis in reviews – creates a product that is overengineered for easier markets. The same pattern has played out in fintech (UPI to global real-time payments), SaaS (Freshworks, Zoho scaling globally from India), and consumer internet. India's 260 million online shoppers today (500 million by 2030) provide the volume to compound the data moat before expanding internationally.

10.7 Founder-Market Fit

The strongest founders in AI commerce combine deep e-commerce operational experience with AI/ML technical capability. Direct experience with payments, checkout systems, marketplace operations, or category merchandising is particularly relevant given the infrastructure integration required. The intersection of commerce domain expertise and AI-first product vision is rare among funded startups globally.

Section 11

The Flash AI Case

This thesis has established that AI will fundamentally restructure how Indians shop – a $125 billion market growing to $345 billion by 2030, with $45–86 billion becoming AI-mediated. Among the global and Indian startups building in this category, Flash AI occupies a unique position. Here is why.

11.1 India-First, Consumer-Facing, Cross-Category

The competitive landscape in AI commerce has organized into clear lanes. Phia ($35M Series A, $185M valuation) is B2B-first, monetizing through brand partnerships in US fashion. Onton ($7.5M seed) is vertical, focused exclusively on furniture. Daydream ($50M seed) is US fashion-only. Amazon Rufus and Flipkart SLAP are incumbent extensions, structurally constrained by their own marketplace ad revenues. Flash AI is one of few startups that is simultaneously India-first, consumer-facing, and cross-category – positioning it at the intersection where the largest opportunity exists.

11.2 Traction That Outpaces Global Benchmarks

Flash AI reached 3 million users in six months (September 2025 to February 2026) with 50% month-over-month growth – ranking #1 globally among Commerce AI apps on SimilarWeb. For context: Phia took 10 months to reach 1 million users. Onton took over a year to go from 50K to 2 million. The combination of rapid user acquisition and strong engagement metrics demonstrates genuine product-market fit – users are not just visiting, they are converting at rates well above industry benchmarks.

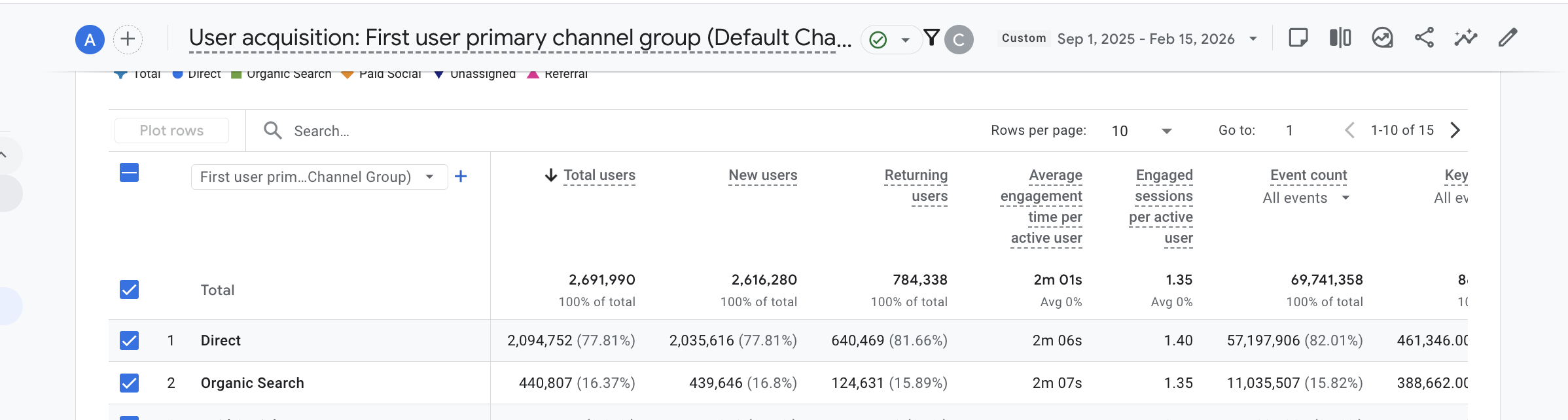

11.3 A Distribution Model Built for India's Scale

Flash AI's activation mechanic – prepending flash.co/ to any product URL – is perhaps its most underappreciated advantage. There is no app to download, no account to create, no browser extension to install, and no learning curve. This zero-friction model has produced a ₹5 CAC in a market where D2C brands pay ₹600–₹1,200 to acquire a single customer. That is a 120–240× efficiency advantage. In India, where 806 million internet users span wildly different levels of tech fluency and device capability, this kind of frictionless activation is not a UX choice – it is a strategic moat. It means Flash AI can scale to the next 250 million online shoppers without the app-install bottleneck that constrains every other player.

11.4 Unit Economics Approaching Crossover

Flash AI's unit economics tell a story of two curves converging at speed. On the cost side, overall cost per thread has collapsed 72% in six months – from ₹11.4 in September 2025 to ₹3.2 in January 2026. This decline is structural, not one-off: AI tech cost per thread fell 68% (₹6.5 to ₹2.1) as the platform optimized inference and caching, while acquisition cost per thread dropped 78% (₹4.9 to ₹1.1) as organic growth compounded and the flash.co/ activation mechanic scaled virally. The gap between cost and revenue per thread will close rapidly with revenues growing with scale, and with LLM inference costs continuing their structural decline (200× drop in 18 months, per Section 03), the cost curve has significant room to compress further. The $10M Series A targets CM1 breakeven by driving revenue per thread higher through deeper merchant integrations and brand partnerships, while cost per thread continues its structural decline – a crossover that the current trajectories suggest is within reach over the next 12 months.

11.5 A Compounding Product Intelligence Moat

Flash AI has built a product intelligence graph leveraging 7 million product searches across 15,000+ merchants. This is not a static catalogue – it is an intelligence layer that aggregates cross-platform pricing, social signals from YouTube and Reddit, expert reviews, and real-time user interaction data. Every research thread adds signal: what products are being compared, what attributes matter most, which price points convert, and which recommendations lead to purchases. This is the data flywheel that Section 10 identifies as the defining moat in AI commerce. Crucially, Flash AI is accumulating this data from the consumer side – intent signals, preference patterns, cross-category behavior – which is the hardest data to replicate and the most valuable for brands. A competitor entering today would need to replicate millions of consumer research sessions to match Flash AI's product understanding.

11.6 Category Sequencing Aligned With Market Readiness

Section 07 established that beauty and electronics are the categories where AI disrupts first – beauty because of research-heavy purchase decisions, lowest return rates, highest repeat rates (30%), and proven virtual try-on conversion lifts; electronics because of objective, comparable specifications where AI excels and where Adobe data shows AI traffic converts at the highest rates. Flash AI's organic category distribution mirrors this thesis precisely.

Today, beauty, personal care, and electronics together account for two-thirds of all products users research on Flash AI. The platform is deepening its advantage in these categories with upcoming deep category experiences: skin analysers, face shape analysers, and ingredient compatibility engines in beauty and personal care; spec-comparison tools and expert-review synthesis in electronics. These are category-specific intelligence layers that deliver a level of personalisation and decision support that neither general-purpose LLMs nor marketplace bolt-ons can replicate, and they compound the product intelligence moat with every interaction.

11.7 Strong Founder-Market Fit

Flash AI's founder served as SVP at Flipkart for nine years (2013–2022), leading Fintech, Payments, Checkouts, and Marketplace – the four functional domains that converge in AI-mediated commerce. This is not adjacent experience; it is direct operational knowledge of the exact infrastructure AI shopping agents need to integrate with. The founder built payment and checkout systems that process billions of transactions for India's second-largest e-commerce platform, and understands Indian consumer behavior – price sensitivity, trust dynamics, return patterns, vernacular needs – at a depth that no US-based AI commerce founder can match. This combination of commerce operational depth and AI-first product vision is rare among funded AI commerce startups globally.

11.8 Built for India, Scaling Globally

Building for India's uniquely challenging environment – extreme price sensitivity, 81% return rates (the world's highest), a compounding trust crisis in reviews, vernacular requirements, and the need to work across both premium and value segments – creates a product that is overengineered for easier markets. The same pattern has played out in fintech (UPI to global real-time payments), SaaS (Freshworks, Zoho building for Indian SMBs then scaling globally), and consumer internet (Airlearn and Pocket FM scaling globally from an India base). India's 260 million online shoppers today, growing to 500 million by 2030, provide the volume to compound the data moat before expanding internationally.

11.9 Structural Advantages Incumbents Cannot Replicate

Flash AI benefits from a structural asymmetry that protects it from incumbent replication. Amazon and Flipkart generate their highest-margin revenue from marketplace advertising – sponsored listings, banner ads, and promoted products that depend on consumers browsing their platforms. An unbiased AI shopping assistant that recommends the best product regardless of advertising spend is fundamentally incompatible with their business model. Amazon generates ~$56 billion annually from such ads; Flipkart and Myntra together generate ~₹10,500 crore from similar sources. These incumbents can build AI features (Rufus, SLAP, MyFashionGPT), but they cannot build a platform-agnostic product intelligence layer without cannibalizing their own ad revenue. Independent AI shopping platforms face no such constraint. They can recommend the best product across every platform, drawing from sources the incumbents will never surface – competitor pricing, independent expert reviews, social sentiment, cross-platform availability – because their incentives are aligned with the consumer, not the advertiser. Flash AI is built on this principle.

11.10 The Demographic Tailwind

Flash AI's user base skews heavily toward younger demographics – a reflection of who is adopting AI-first commerce. India has 377–400 million Gen Z consumers who drive 43% of consumer spending, 64% of whom already use GenAI for shopping (BCG). AI commerce startups that capture this cohort as they form their shopping habits will build exponentially valuable preference data as these users age into higher spending power over the next decade. Flash AI's early traction with this demographic positions it well for this compounding effect. This is the same demographic compounding that made Instagram and Snapchat generationally durable consumer products.

Section 12

What's Next for Flash AI

Flash AI is raising a $10M Series A to execute on three priorities over the next 12–18 months: scale to 4 million MAU by December 2026 and 12 million by December 2027, reach CM1 breakeven, and deepen the product intelligence moat across categories and geographies.

12.1 Current Metrics Snapshot

12.2 Category Expansion

Today, beauty, personal care, and electronics together account for two-thirds of all products users research on Flash AI – aligned with the category sequencing thesis in Section 07. The next phase deepens these categories with purpose-built experiences:

Beauty & Personal Care: AI-powered skin analysis matching products to skin type, tone, and concerns; ingredient compatibility engines flagging allergens and contraindicated combinations; face shape analysers for makeup and eyewear; and virtual try-on for shade matching.

Electronics: Structured spec-comparison tools that normalise specifications across brands; expert-review synthesis weighted by credibility; compatibility checkers for accessories and peripherals.

Grocery (Phase 3, 2027): Following Section 07's category sequencing, grocery ($7.4B quick-commerce GOV, 40%+ annual growth[104]) is the natural next expansion – standardised SKUs, repeat purchases, and low subjectivity make it ideal for AI-mediated commerce.

12.3 Geographic Expansion

Building for India's uniquely challenging environment creates a product that is overengineered for easier markets. The expansion playbook follows a proven India-first pattern:

Southeast Asia (2027): Similar structural dynamics – high mobile penetration, fragmented e-commerce (Shopee, Lazada, Tokopedia), growing digital payments infrastructure, and a young, AI-native consumer base. India-built AI commerce infrastructure translates directly to Indonesia ($82B e-commerce market), Vietnam, Thailand, and the Philippines.

United States (2027–2028): The largest e-commerce market globally ($1.2T+). US consumers face the same trust and research-overload problems at a different scale. The Phia ($185M valuation) and Daydream ($50M seed) valuations demonstrate US investor appetite for AI commerce. Flash AI's India-built product intelligence graph provides a data advantage that US-only competitors cannot match.

12.4 The Fundraise as Accelerant

The $10M Series A targets three measurable milestones:

Scale MAU: Grow from 852K to 4 million monthly active users by December 2026 and 12 million by December 2027, leveraging the ₹5 CAC and zero-app-install distribution model that has driven 50% month-over-month growth.

CM1 breakeven: Scale the hybrid affiliate + brand intelligence revenue model. With cost per thread at ₹3.2 and declining (down 72% in six months), the revenue-cost crossover is within reach as merchant integrations deepen and brand partnerships scale.

Product intelligence moat: Deepen the product intelligence graph (currently 7M product searches across 15,000+ merchants) with deep category experiences in beauty and electronics, and begin grocery category development for 2027 launch.

The Timing Window

The company that captures India's product intelligence layer in 2026 will compound its data moat through 2030 and beyond. With BigBasket transacting on ChatGPT via UPI, Flipkart endorsing UCP, 64% of Indian consumers using GenAI for shopping, and AI shopping queries doubling every six months – the category is moving from experimental to infrastructural. The timing window is 12–18 months. Flash AI's capital efficiency (₹5 CAC, zero-install distribution, improving unit economics) means this raise buys meaningful runway to capture the defining position.

Appendix A

U.S. AI Commerce Investments & Updates (2025–2026)

| Company | Round / Milestone | Valuation / Size | Lead Investors | Date |

|---|---|---|---|---|

| Phia | Series A | $185M val / $35M | Notable Capital, Khosla, KP | Jan 2026 |

| Daydream | Seed | $50M | Forerunner + Index Ventures | Jun 2024 |

| Flash AI | Series A (in progress) | $10M (raising) | Blume Ventures, PeerCapital | Sep 2023 |

| FERMÀT | Series B | $45M | VMG Partners | 2025 |

| Peec AI | Series A | $21M | Singular | Jan 2026 |

| Dazzle (Marissa Mayer) | Seed | $8M / $35M val | Forerunner | Dec 2025 |

| Onton (fka Deft) | Seed | $7.5M | Footwork | Nov 2025 |

| Dupe | Seed | $5.5M | Kindred, M13 | Sep 2021 |

| Beni | Seed | ~$5M | Buoyant, Better Ventures | 2022 |

Total VC in AI globally (2025): $202.3 billion, capturing ~50% of all global VC funding (up from $114B in 2024).[127] Elite VCs (Sequoia, Khosla, a16z) invested $428M+ in 7 AI-first commerce startups in 2025.[128]

Appendix B

VC Thesis Publications

Sequoia Capital (Aug 2025): Konstantine Buhler, "The $1T Opportunity to Build the Next Amazon in Retail." AI wins through expert question-answering. Explicitly believes an Amazon-scale ($2T+) company will form. Read →

Sequoia Capital (Jan 2026): David Cahn, "AI in 2026: The Tale of Two AIs." Predicts "$0 to $1B club" – AI startups reaching $1B revenue. Agent economy targets $10T+ services market. Read →

a16z (Aug 2025): Justine Moore & Alex Rampell, "AI × Commerce." Five-category purchase taxonomy. Key insight: Google could lose 95% of search volume and still grow revenue if it retains commerce queries. Read →

a16z: "AI Shopping Online." How AI is reshaping online shopping behavior and discovery. Read →

a16z: "The Death of Search – How Shopping Is Changing." Safari search declined for first time in 20+ years. Read →

General Catalyst (Dec 2025): "The Agentic Commerce Opportunity." Consumer moves from executor to strategist. Identified GEO replacing SEO. Flagged discovery + payments as critical infrastructure gaps. Read →

Lightspeed Venture Partners (Dec 2025): "Consumer Building Blocks in the Age of AI." Read →